Inflation expectations correspond to what economic agents believe inflation will be in the future. This is a variable that is relevant to monetary policy and to the general performance of the economy since it influences how the prices for goods and services, wages, and the prices of financial assets are determined. An important concept in the study of expectations is that of "anchoring," which tells us if they tend to have a stable value over time, which is known as the "anchor". Knowing the value to which expectations converge over the medium to long term indicates how credible monetary policy is. In addition, if the value that expectations reach is close to the long-term inflation target, it can be inferred that the target established by Banco de la República (BanRep) is credible.

A recent BanRep paper published in the September 2021 edition of Ensayos sobre Política Económica (ESPE No. 100, 2021, p.23), estimates the value of the anchor at different horizons and examines whether this value has changed over time. Data on inflation expectations reported by different economic agents in the Monthly Expectations Survey (EME in Spanish) of economic analysts and in the Quarterly Economic Expectations Survey (ETE in Spanish) were used for the analysis. These are surveys carried out by BanRep that ask how much inflation is expected to be in the future. Each month, the first survey is answered by analysts at banks, stockbroker firms, and other institutions (for example, pension and severance funds, insurance companies, and economic research centers) from all over the country, whose routine activities include producing inflation forecasts for Colombia, . This survey asks about the value that analysts believe inflation will reach at different periods of time – up to two years (i.e., if we are in October 2021, we ask about inflation expectations for October 2023). The ETE is answered every three months by companies in the manufacturing and mining industries, the financial sector, large chain stores, transportation, communications, academics, consultants, and unions in Bogotá, Medellín, Cali, and Barranquilla. This survey asks about headline inflation expectations for the next 4 quarters 1.

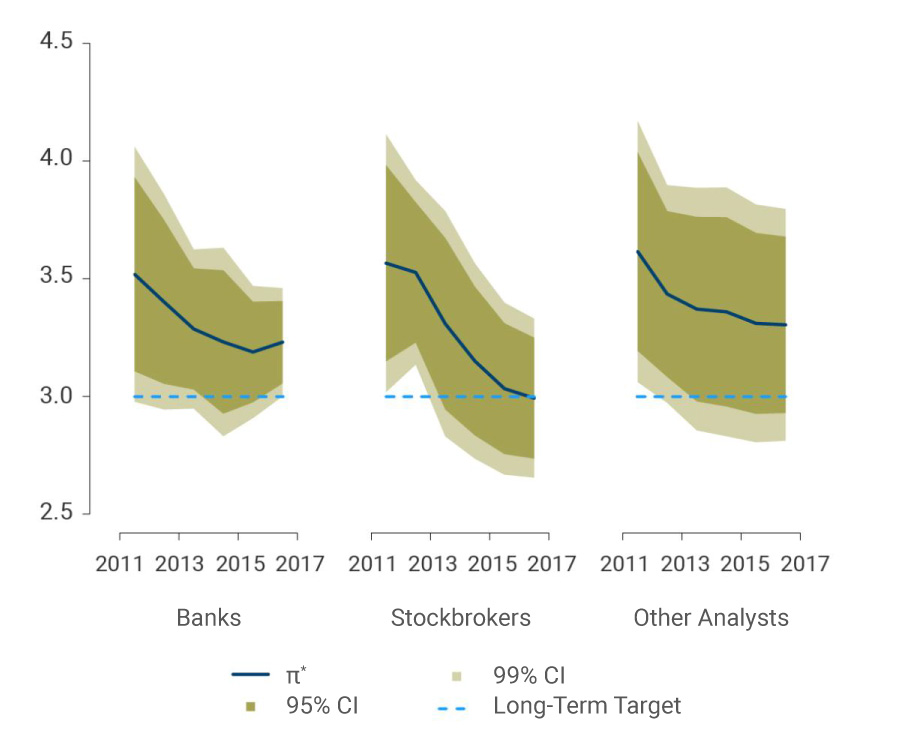

In the aforementioned document, the EME is used to obtain analysts' answers to the question of what inflation will be in two years. With this information, the average value expected by economic analysts for each of the months during the period from January 2009 to December 2019 is calculated. This makes it possible to obtain the value of the anchor for banks, stockbrokers, and other analysts as shown in Graph 1. As can be seen, the value of the anchor has decreased over time for all three groups.2 Thus, at the end of the period analyzed, the value of the anchor is 3.2% for banks, 3.0% for stockbrokers, and 3.2% for other analysts. It can also be observed that Banco de la República’s inflation target (3.0%) is included in the confidence intervals at 99% probability. This suggests that the expectations of all three groups are anchored to the inflation target determined by the Board of Directors of BanRep in the most recent period. In other words, the inflation target has high credibility among the surveyed agents.

Graph 1

Estimated Value of the Anchor for Horizons of up to 24 months over time

Source: Banco de la República (Monthly Survey of Analysts’ Expectations), authors’ calculations.

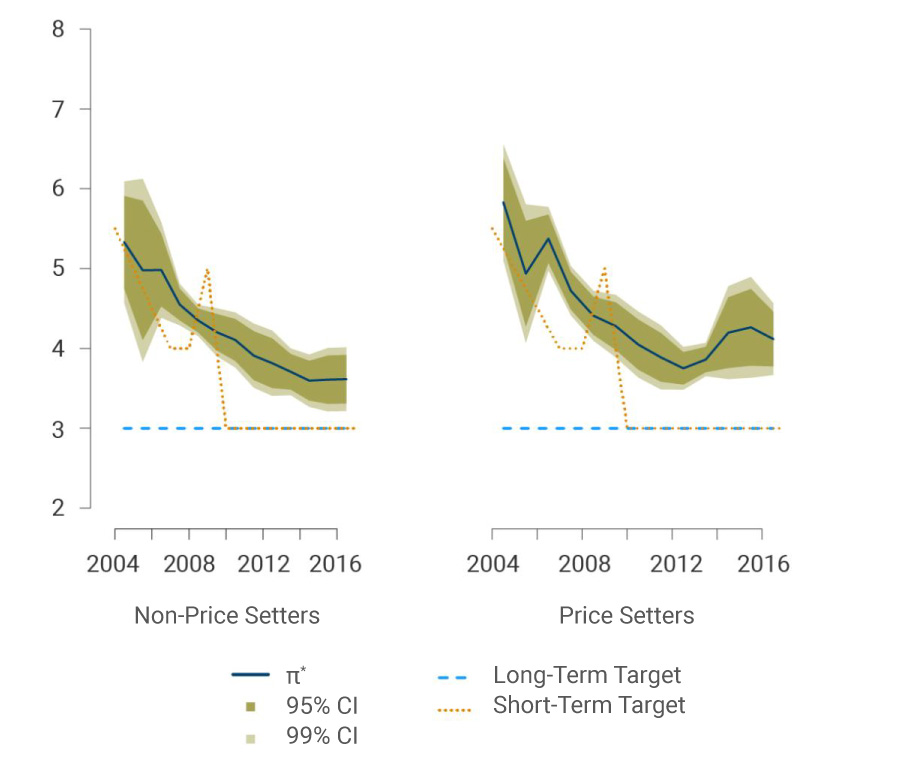

The analysis described above was also done using ETE. In this case, to study the evolution of the anchor over time, two groups of agents were formed based on their ability to actively intervene in price setting and wage negotiations. The first group is Price Setters, which includes companies from the industry, retail stores, and transportation and communications sectors; the second group is Non-Price Setters, which includes the financial sector, and academics and consultants3. The survey has information from the first quarter of 2004 through the fourth quarter of 2019, and uses the average of the inflation expectations from the respective sectors for a horizon of up to four quarters. Graph 2 shows a sustained reduction in the estimated anchor, although the value obtained is statistically different from the target. In the case of Price Setters, the value of the anchor has increased in recent years and is above 4.0% while, for Non-Price Setters, the anchor has recently stabilized and is around 3.5%.

Graph 2

Estimated Value of the Anchor for Horizons of one to four Quarters for the Price Setter and Non-Price Setter Groups.

Source: Banco de la República (Quarterly Survey of Expectations) authors’ calculations.

Although the estimated value of the anchor varies among agent types, the analysis concludes that it has persistently decreased over time. During 2021, BanRep staff calculations indicate that the estimated value of the anchor has remained relatively stable despite the fact that short-term inflation expectations have gone above target. This implies that the increase in inflation is expected to be temporary and is consistent with BanRep's policy of responding to shocks that cause deviations from the policy target in medium- and long-term inflation expectations.

1 This survey also asks about 8-quarter inflation expectations. However, they are not included in the exercise because they have only been available since 2016.

2 The horizontal axis of the graph represents the midpoint of the period used for estimating the anchor over time, using a six-year window that implies that the last observation corresponds to 2016.

3 Unions are not included in these groups because, although they participate in wage bargaining, they are motivated when setting their expectations towards higher levels of inflation than the other sectors.

.png)