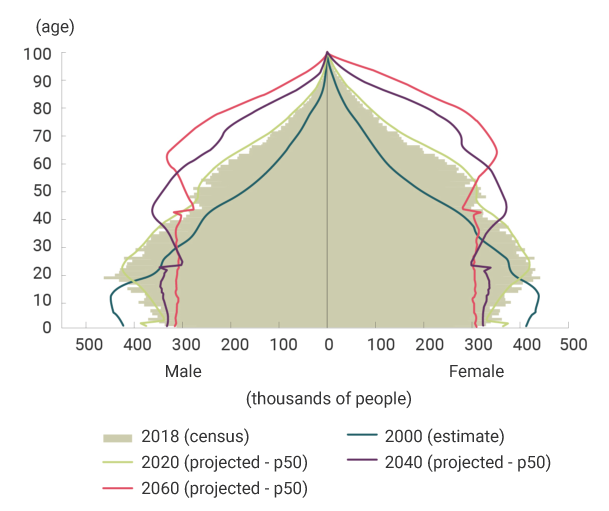

Population aging poses a serious challenge to the Colombian pension system. Graph 1, taken from the document “Sistema pensional colombiano: descripción, tendencias demográficas y análisis macroeconómico” published in Banco de la Republica’s Revista de Ensayos de Politica Economica (ESPE)—the Journal of Economic Policy Essays—illustrates the estimated reduction in the proportion of the young population and the consequent increase in the proportion of the older population between 2000 (dark green line) and 2060 (red line). This includes the 2018 census (green bars).

These demographic projections imply that the dependency ratio, defined as the ratio of the working-age population (from age 18 to the legal retirement age) to the pension-age population (above the legal retirement age), would fall from 4.6 in 2018 to 1.7 in 2060. In other words, for every person of pensionable age the number of people of working age is expected to drop from almost 5 today to almost 2 in 2060. These projections mark a strong structural change since, in the eighties of the last century, the dependency rate was higher than 8 and, going further back, in the fifties of the same century, it was higher than 9.

Graph 1: Expected Changes in Colombia's Population Pyramid, 2000-2060.

Source: Parra-Polanía et al. (2020).

The Colombian pension system includes two separate pension schemes. There is, on the one hand, a simple pay-as-you-go public scheme with substantial subsidies that will be directly affected by the expected demographic change, since the funding of adult pensions comes from the contributions of people of working age, whose number will be decreasing compared to those who reach pension age. On the other hand, there is a private savings scheme, in which every individual has an individual account that is not directly affected by demographic changes insofar as their pension depends on their capitalized savings. However, the subsidies implicit in the pay-as-you-go scheme generate incentives to move from the private to the public scheme under the terms allowed by the regulation and depending on the conditions of each individual. These incentives complicate any attempt to forecast the fiscal costs of the pension system in the future.

A paper by Julián Parra and Fernando Arias, researchers at Banco de la República, that was recently published in the Bank’s series Borradores de Economia provides an illustrative calculation of the projected growth of the pension system costs. Specifically, the increase in the government's expenditureneeded to pay the pensions they are responsible for is calculated with respect to the current requirements and exclusively because of the aging population. In other words, this is a conservative estimate that is detached from policy discussions but gives an idea of the impact of demographic change on the sustainability of the current pension system. Assuming that the resources needed to cover the additional pension payments resulting from population aging should come exclusively from higher taxation on labor income at each point in time, the document in reference estimates that the tax rate on such income, which is estimated at 6.5% on average for the current situation, would have to double by 2060 and be multiplied by 3.3 in the longer term, as shown in Graph 2.

As mentioned above, this is a conservative calculation that assumes that there is no pension reform and, therefore, that the pension age and other parameters used to calculate the pension in the pay-as-you-go scheme remain constant. It also assumes that the coverage of the system is maintained at the current 25% rate and does not address the subsidies required to cover minimum pensions. Even so, the size of the projected shortfall is substantial and should serve as a reference for policy discussions on possible reforms to the system.

Graph 2: Trajectory of Tax on Labor Income, Net of Mandatory Pension Contributions

Source: Arias-Rodríguez and Parra-Polanía (2021)

.png)